For Serbian startups, the journey to securing significant funding from venture capital firms has often been met with obstacles. Garaza, a Belgrade-based community of tech startup founders supported by blockchain development platform Tenderly, recently published its 2023 report, shedding light on why investors frequently decline investment opportunities in Serbian startups.

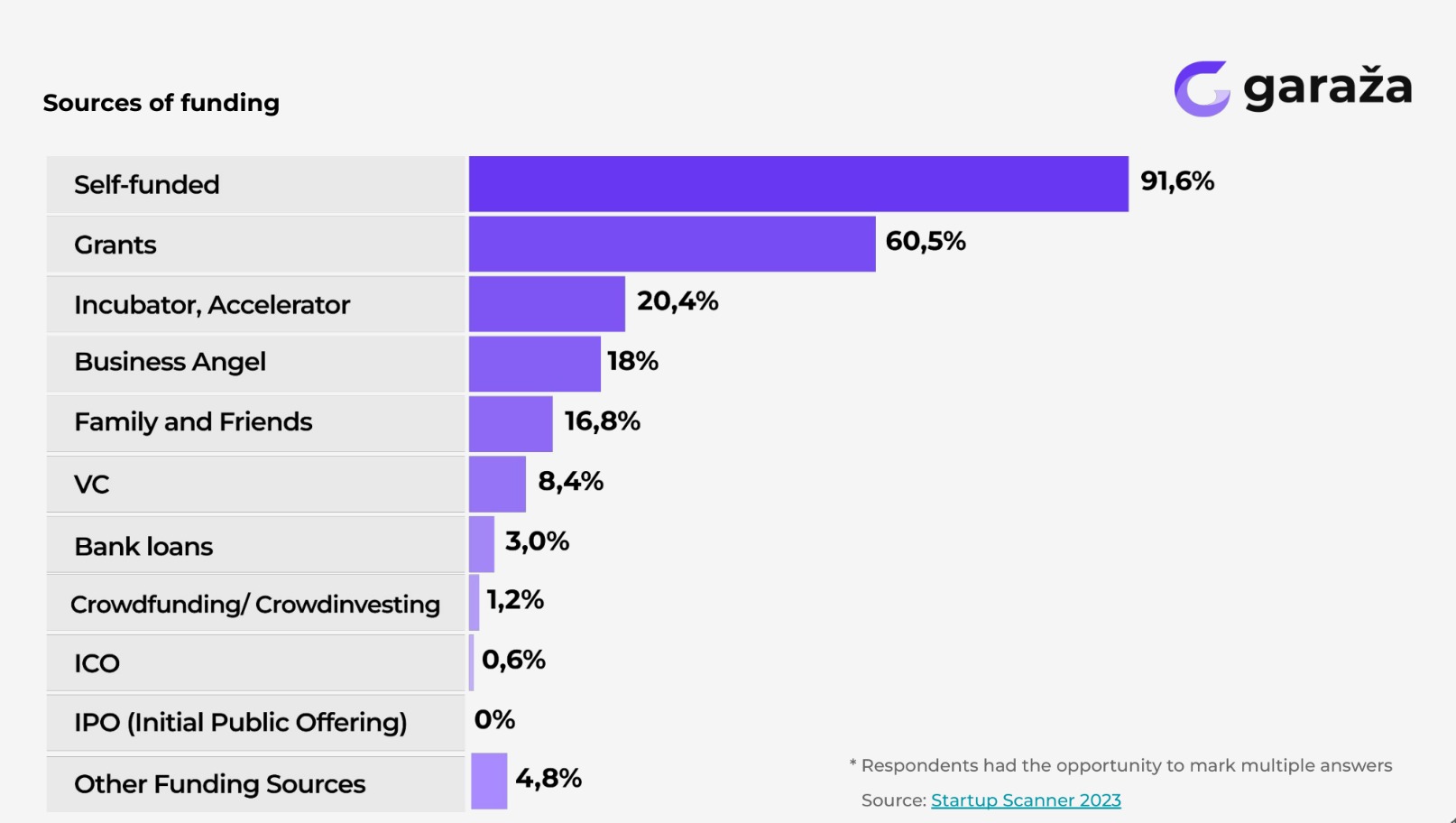

According to Garaza’s report, the majority of financing for Serbian startups comes from personal funds, grants, family and friends, incubators/accelerators, and angel investors. However, VC funding remains limited, comprising only a small fraction of startup financing. This disparity underscores the need for local startups to address key issues that hinder their attractiveness to VC funds.

“The Investor Garaža Report was created to help Serbian startups identify fundraising challenges and get first-hand investors’ advice on overcoming them. It is sort of a checklist for startups to go through and self-diagnose,” Milena Milic, program coordinator at Tenderly, tells IT Logs.

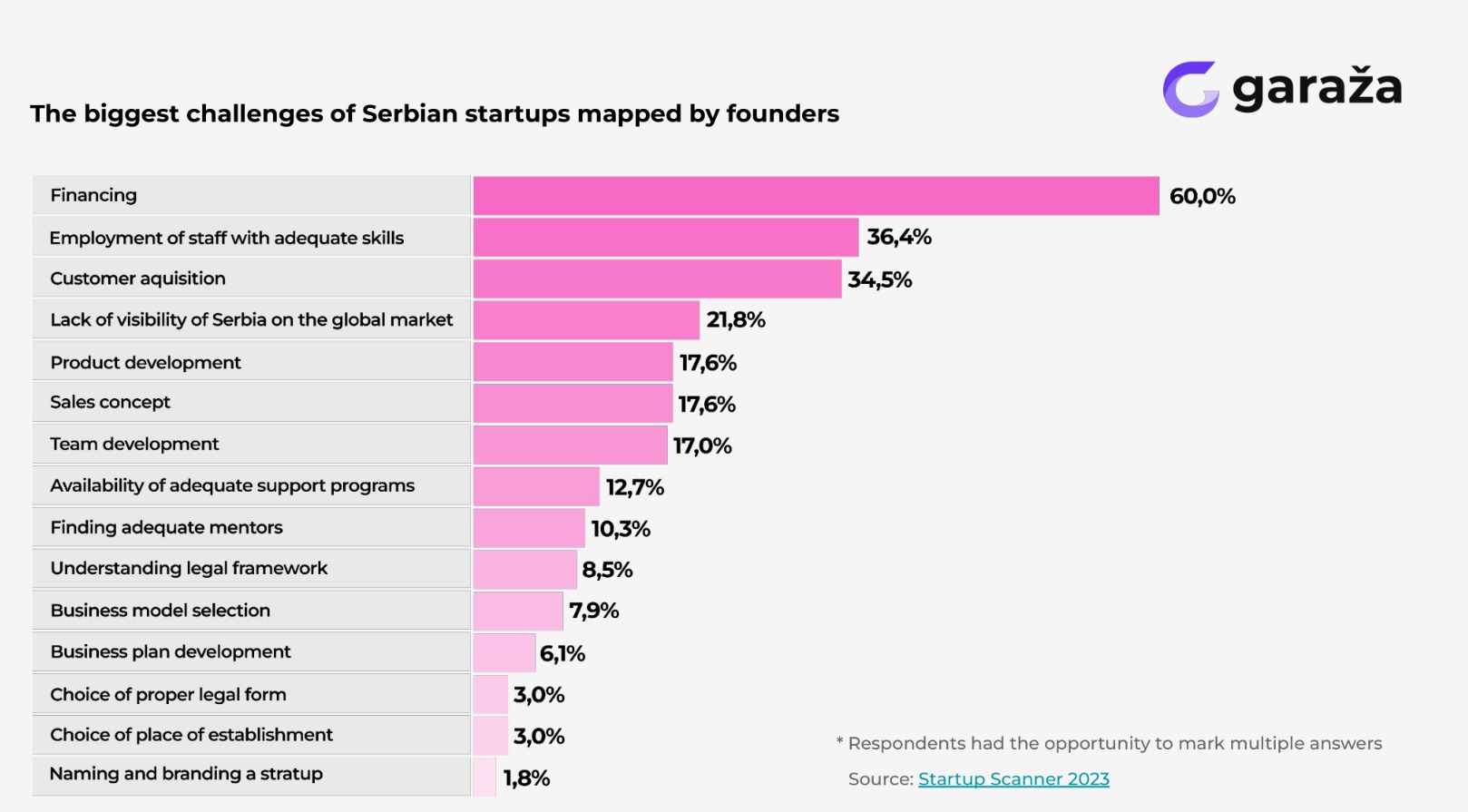

Lack of commitment from the founders as well as insufficient business skills are just some of the key insights of the report, that further point out the critical areas where Serbian startups need to focus their efforts to attract more significant investment from venture capital firms and angel investors.

Lack of founder commitment

Investors emphasize the importance of founder commitment. If founders themselves are not fully invested in their startup’s success, investors are unlikely to be convinced to commit their resources.

“The team should have a balanced structure, with founders focusing on both the technical and business sides of the startup. Any startup can immediately improve its investment readiness by assessing the team’s skills, identifying gaps, and seeking additional members or training to bridge them. Demonstrating full commitment to their startup and showing openness to feedback are crucial steps startups can take immediately to signal their dedication and adaptability to potential investors,” Milic further elaborates on some of the findings of the reports.

Insufficient business acumen

Successful founders often possess a blend of technical expertise and sales skills. Investors seek founders who can navigate both the product development aspect and effectively sell their vision to customers and investors alike.

Resistance to mentorship

Founders who are not open to mentorship and guidance may struggle to navigate the complexities of scaling their startup. Investors advise startups to engage with experienced mentors who can offer valuable insights and support.

Fear of validation

Startups must showcase robust traction and validation metrics to instill confidence in investors. Merely having a promising idea is not enough; tangible progress and customer validation are crucial.

Over-reliance on local markets

Investors caution against startups that solely target local markets. A global mindset and a strong go-to-market strategy that extends beyond domestic borders are essential for sustainable growth and investor interest.

“Investors are looking for high ROI, so startups on a VC route should adopt a global perspective from day one. They should conduct market analysis beyond local and regional boundaries, identify potential global customer segments and tailor solutions to meet their needs. Engaging in early and ongoing conversations with potential customers helps startups define and refine their products based on market needs, helping to achieve product-market fit,” Milic tells IT Logs.

Lack of differentiation

Startups must articulate their unique value proposition and competitive advantage clearly. Understanding global competition and positioning oneself effectively in the market narrative are key elements that investors look for.

Ineffective communication

Founders must effectively communicate their startup’s value proposition without relying on jargon or buzzwords. Clarity and conciseness in explaining the problem-solving aspect of their product or service are crucial during investor pitches.

Minimal sales traction

Investors prefer startups that address pressing customer pain points rather than offering superficial solutions. Building a “painkiller” product that solves a critical problem is more likely to attract customers and investors alike.

Vision and scalability

Founders must demonstrate a vision for international expansion and scalability from the early stages. Thinking big and aiming for significant market penetration are attributes that investors value highly.

“Startups should define and effectively communicate their value proposition and USP to all stakeholders. It is crucial to be able to clearly and concisely explain what value your product brings in order to attract and retain customers, investors, and partners. Regular, open communication with potential investors is essential for building trust and showcasing progress. Frequent updates to potential investors keep the startup fresh in their minds and help showcase continuity and ongoing progress.” Milic concludes.