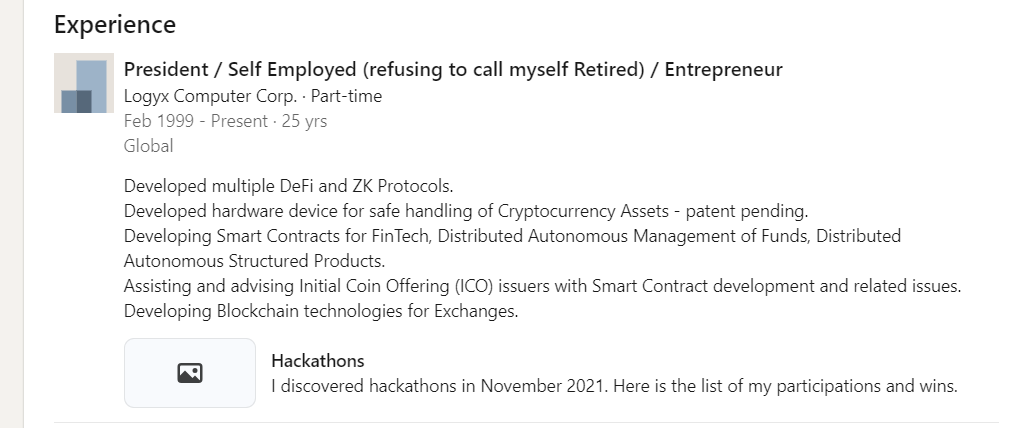

Sixty-year-old Jordan Stojanovski isn’t your average retiree. A veteran in the financial sector, Stojanovski has been making waves in the web3 space for the past few years, blending his 30+ years of experience in the tech industry. The reason behind this is his strong passion for exploration, but also as he explains, wanting to have “fun” by building various web3 projects.

While Stojanovski’s journey began in Michigan, where he pursued graduate studies, ultimately the path led him to New York due to his involvement in the financial industry. His career spans various facets of technology, from studying compiler design to running a hedge fund, retiring early at 45 but keeping his profession alive as a hobby. An interesting twist in his story involves the ownership of the domain jordan.com, showcasing his strategic thinking and patience.

Later on, his foray into the web3 and blockchain space was fueled by his interest in computational complexity, cryptography, and the potential for personal sovereignty. Despite an initial skepticism about Bitcoin, he revisited the concept in 2016, eventually diving into the world of decentralized autonomous organizations (DAOs) and DeFi.

In an interview with IT Logs, Stojanovski reflects on the journey that began from his early days studying Computer Science in Ljubljana, and all the way to his recent achievements in decentralized finance (DeFi) and zero-knowledge (ZK) projects.

IT Logs: Could you share a bit about your background, beginning and entrepreneurial career – basically how did you end up in New York?

Jordan Stojanovski: I moved to the USA to continue with graduate school. Lived in Michigan for 10 years, but because of my involvement with the financial industry, it was logical to move to New York. It was also fun to be in New York at that age.

Walk us shortly through your 30+ yrs involvement in the tech industry and how did this journey gradually evolve and get to where you are today?

I studied Computer Science in Ljubljana, Ms. Computer Science in Wayne State Univ. in Detroit, continued to University of Michigan in Ann Arbor for PhD and dropped out of it when I was almost done, for a business opportunity that eventually did not work out. I started early with my interest in Math, Electronics and Computers at a young age and competed in Math, Physics and Computer Science throughout my schooling. I had interests and results in compiler design (wrote a Prolog compiler for Jozef Stefan Institute), automated trading models and AI (developed trading platforms commercial and proprietary and trading models based on mathematical observations and machine learning), ran a small hedge fund with 2-4 partners, retired early at 45 but kept my profession as a hobby. Still, once in a while I pick up interesting projects.

There is an interesting story about your ownership of the website jordan.com – could you tell us some details about the story itself?

I had a huge list of available domains around 1990, but a friend convinced me against getting into it. Yet I got jordan.com because Jordan is my name. There were many interested parties for acquiring it, but at a very low price. I realized I had to park the domain with an advertising agency to be able to demonstrate its value. I realized I had to build an advertising aggregator to maximize the revenue and so I did, but not with an intent to run it as a business, but merely to improve the perceived value of the domain. I was able to show decent revenue and negotiate a notable sale to Nike when approached. I had to be patient, which paid off after almost 15 years.

Talking about your latest endeavors, what motivated a retired fintech expert to enter the world of web3 and blockchain and what got you started in the space?

I was interested in computational complexity and cryptography, which was closely related to my unrealized PhD work, and a related technology to blockchain and zero knowledge cryptography. That intrigued me as an interesting topic. I downloaded the Bitcoin repo and paper in late 2010, and unfortunately failed to believe it will take off, based on its instability and usage complication. On the philosophical end, I am a believer of personal sovereignty and separation of money and state, as I see an ever increasing totalitarianism developing worldwide. Around 2013 I revisited the Bitcoin idea, and even tried to start a project with a couple of friends, with whom we failed to raise funding. Dropped it again until 2016 when I saw the first prospects of DAO and DeFi. I build many “toys” without thinking about how to commercialize them, all as a hobby.

On a similar note, how have you seen the web3 space evolving during the past few years, and how does this fare with your own expectations about the web3 industry itself? What is your long-term vision for the industry?

Web3 is in its early stages, but it is showing very fast technological growth. I am still surprised the mass adoption is not here yet. I have high hopes that in the next market cycle there will be financial attraction to it, which will drive attention and adoption to its functionality. It is here to stay, for sure.

What personal values or beliefs drive your passion for working in the web3 space?

I have to admit, entertainment is my main personal driver. I simply love my profession and regardless of financial gain, I am enjoying tinkering with it. It’s a perfect aphrodisiac for my inclination in Math and programming. At the same time, as we age we all become “philosophers”, and I am no exception. My beliefs in personal sovereignty, privacy and anti-totalitarianism have been amplified as I see this technology can make them a reality.

In your opinion, what societal problems can web3 technologies effectively address?

Our monetary system is controlled by a handful of bureaucrats in the US. Their incompetence and greedy sense of entitlement is damaging the financial well-being of the entire world. That has to stop, and web3 can offer a good solution. Not just as a monetary system, but also as a slew of financial tools for lending, exchange, trading, hedging etc. in a more honest and fair manner. Then comes sovereignty of individuals and peoples (not just countries): the monetary system has been weaponized and the bureaucracy and corruption is taking over our daily lives. DAOs and Decentralization will allow for simplification, transparency and financial sovereignty in a more meritocratic manner.

What do you see as challenges when it comes to the mainstream adoption of web3 technologies?

I believe the main obstacles are not technical. The obstacles are the bad actors, trying to stop the progress. Governments are trying to institute CBDCs (Central Bank Digital Currencies), which have nothing to do with decentralization, sovereignty or even blockchain. Regulation bodies will attempt to block the progress in fear of loss of the old corrupt ways. Especially in the USA, the fear of losing the Dollar reserve status, the government will try to block technological progress, and even villainize the inventors.

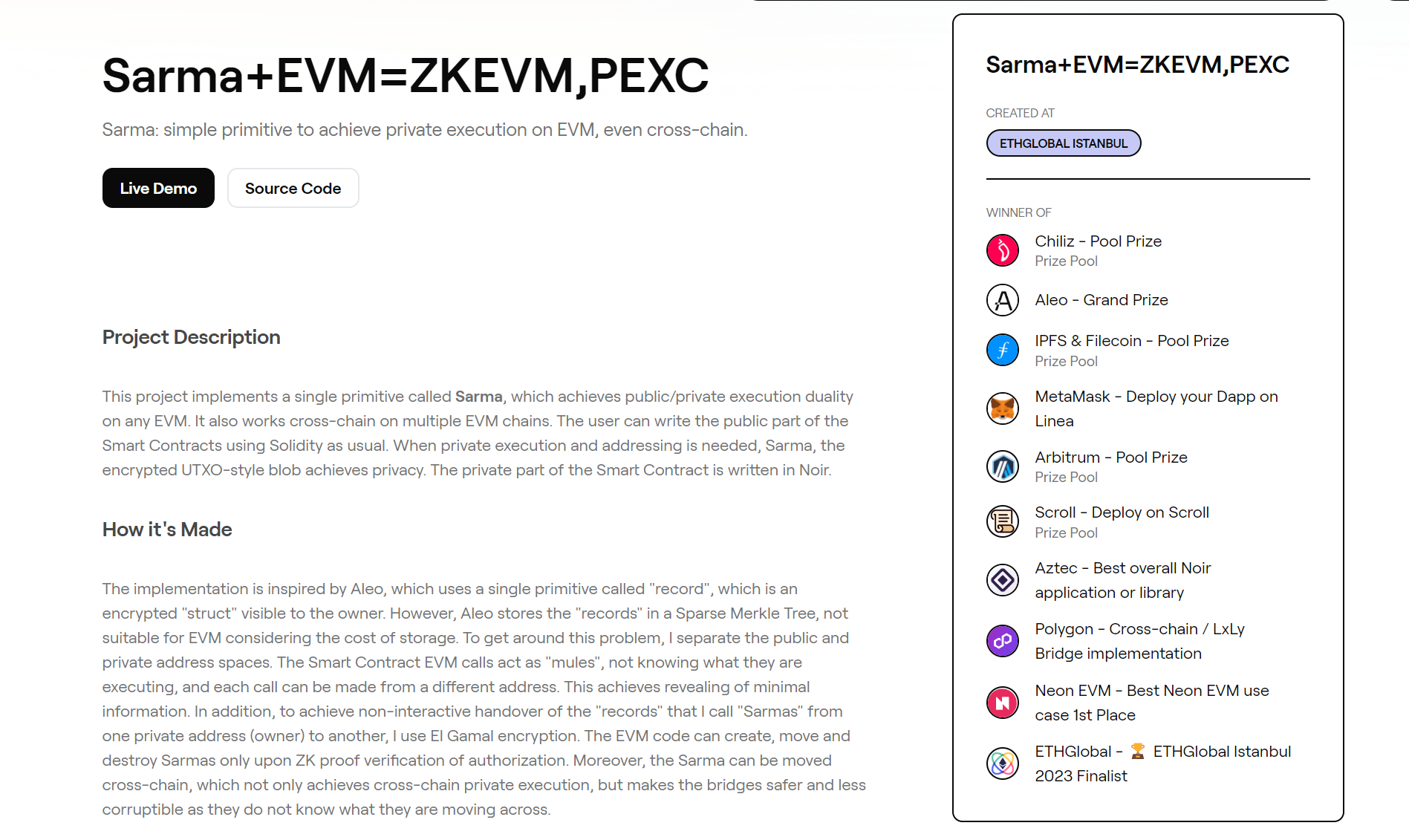

One of your latest hackathon projects, Sarma, won multiple awards on ETH Global Istanbul. What are some specific use cases or scenarios where features provided by Sarma are particularly beneficial?

Sarma is a general purpose tool which will facilitate privacy and private execution on EVMs (Ethereum Virtual Machines) and other blockchain VMs in the future. Blockchains are fully transparent, and when there is a need for privacy, Zero Knowledge cryptography can help. Otherwise, no proprietary business information, transactions and calculations can be put on the blockchain. Not only privacy, but also proofs of validity of off-chain calculations are needed. The blockchains are slow and inefficient simply by virtue of the consensus mechanisms which require multitude of participants duplicating the same execution. But if someone can prove that they did certain execution as described, the blockchain can provide cooperation in an honest, sovereign and incorruptible manner, in a private manner if needed.

Technically, there are already private execution blockchains, such as Aleo, Aztec and Mina, but the EVM is the most popular platform and most of the DeFi capital is deployed on EVMs. Sarma will enable private execution on EVMs, with minimal overhead.

Can you share some of the most significant achievements in your career and how have these awards impacted your approach to your work?

I am not sure what I do is a career – it’s entertainment. The awards don’t impact it technically, but they bring attention. Earlier in my life, when it could be called “career”, they attracted investment. Now, they attract attention, so I can meet like minded people and socialize and exchange ideas. I am 60 years old and I lived in the old world, where everything was confidential. Everything that I did was a “trade secret” and I am so happy to be able to share everything now. Let me try: I was proud of my Math and Physics competition awards as a student. Then the Prolog compiler that I developed single handedly made me very happy when I was in my early 20s. I developed several tools for automated trading, and I borrowed a lot of ideas from Physics and Math in modeling market behaviors – that was fun and profitable. I’m also happy that at my age my hacks are recognized and awarded at hackathons. This may be clichet, but I am very happy with my achievement to motivate my children to seek knowledge.

You’ve participated in different hackathons with your daughter. Working as a father-daughter team is unique, how do you find the experience of collaborating on various coding projects together?

Children don’t usually listen to their parents. This changed it a little in our case, and I enjoy spending time with her in such a setting. She is fast and bold, I overanalyze everything before I even start, but together these differences compensate each other.

Do the generational differences bring a unique perspective to the projects that you are working on?

Yes, and my mind becomes younger as a result. She jumps into everything fearlessly and I go “let me try it, too”.

Could you share a bit about the most prominent DeFi and ZK projects you’ve developed, what challenges do they address and what’s your plan for them?

Here is the list of my hacks (at hackathons) in the past 2 years: https://jordan-public.github.io/ . I learn as I go, but all of them revolve either around improving swapping, leverage, liquidation and oracles, as I’m comfortable with financial constructs, or ZK. In ZK I am like a kid in a candy store, and I don’t exactly know in which direction I am going, but I like its applications (voting, secret oracle) as well as tools (Sarma). I have used AI previously both as developer and user, and I have one hack with AI (UMAIA) and likely more coming in the area of ZKML (ZK Machine Learning) as I am reading about it. I am spending a lot of time learning ZK math and I’m sure something will come out of that. I’d like to believe I have common sense about what is needed and useful as products, but am not in a hurry to dive into it as a business. Instead, I’m just hacking as criticism to ideas and products I see around and I am sure something will emerge. Eventually I’ll be responsible to follow through with these ideas or maybe help someone else realize them. I do get grant offers and VCs talk to me, but I am also patient.

Talking about specific segments of the industry, how do you see the future of decentralized finance evolving, and what role do these protocols play? Especially now after the Bitcoin ETF being approved…

I believe the Bitcoin ETF approval is good for the market in the short term, but detrimental in the long run. Why should someone get ETF shares instead of real on-chain Bitcoin? Eventually, the greedy corporate actors will start selling ETF shares without real Bitcoin behind them and cheat the holders. Look at the Gold – financial gold instruments are sold in amounts of vast multiples of the amount of real gold. The pension funds are forced to hold an ETF because they are “not allowed” to hold real Bitcoin in them. That is because the owners of the funds are treated a priori as criminals, and the real criminals as saviors.

But, in the short term, the ETFs will accelerate the awareness, and thus the DeFi adoption, even though the ETF holders are not allowed to touch DeFi.

Collaboration is key in the tech industry. How do you approach collaboration with other projects or entrepreneurs in the web3 space?

Collaboration is the greatest achievement in the software industry in general, but permissionless composability in web3 has lifted the collaboration to a new level. Open source and open licensing is great, but we can do better, and that is permissionless composability. In web3, if I produce a DeFi protocol that interacts with other permissionless protocols, I don’t have to make a business deal or seek a license to integrate with them. I don’t have to ask anyone, and no permissions are needed – just compose. Uniswap does not even know how many protocols have integrated with them. That brings and improves the business for all (inadvertently!) involved parties.