Emerging economies like Albania, which endured a decades-long dictatorship up to the beginning of the 1990s, often serve as a strong example about what it takes to fully embrace capitalism.

While Albania’s economy is experiencing rapid growth, the transition from a closed economy to an open one involves implementing sound business practices, and initiating a series of legal and economic reforms aimed at accelerating its accession to the European Union.

These challenges are not unique to Albania; many emerging economies within the Balkans grapple with analogous dilemmas. Traditional financing options often fall short, plagued by exorbitant interest rates, restricted access to credit, and economic volatility.

Real estate developers, for instance, have resorted to unconventional practices such as pre-selling units or participating in barter economies to secure funding for their projects.

Modern challenges require modern solutions

Amid rising challenges, many countries are turning to modern technologies that can reshape the trajectory of their economies. Blockchain technology is one of them.

In the financial domain, blockchain and its potential has been attracting the attention of financial giants like BlackRock and J.P. Morgan in the West.

Leading consulting firms such as McKinsey and Deloitte regularly publish reports on how blockchain will revolutionize the financial landscape.

What exactly is blockchain doing for emerging economies?

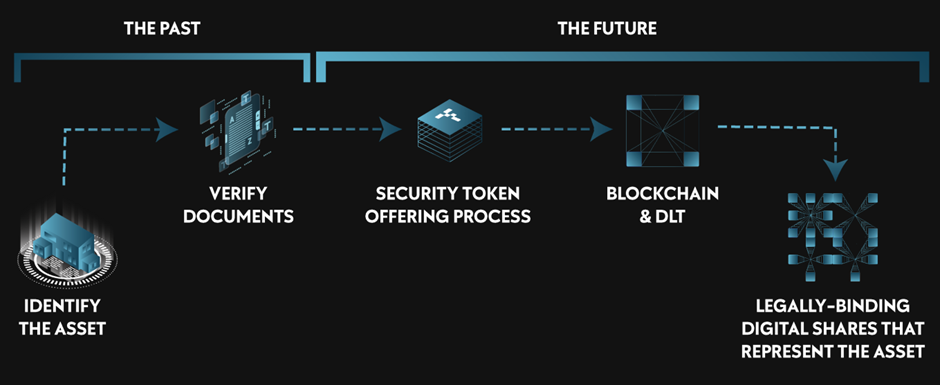

Tokenization is the process of digitizing real-world assets through blockchain technology. It’s akin to turning tangible assets like real estate into digital shares that can be traded on the web with fewer intermediaries, fewer costs, more efficiency, and higher transparency than in the traditional real estate business.

Tokenization addresses a multitude of problems that emerging economies face. By dividing real-world assets, such as real estate into digital shares tradable on the internet, it generates exposure to global investments on an unprecedented scale. This influx of global capital is delivered in an efficient and compliant manner, solving the liquidity issues that have long plagued these economies, while maintaining security and transparency.

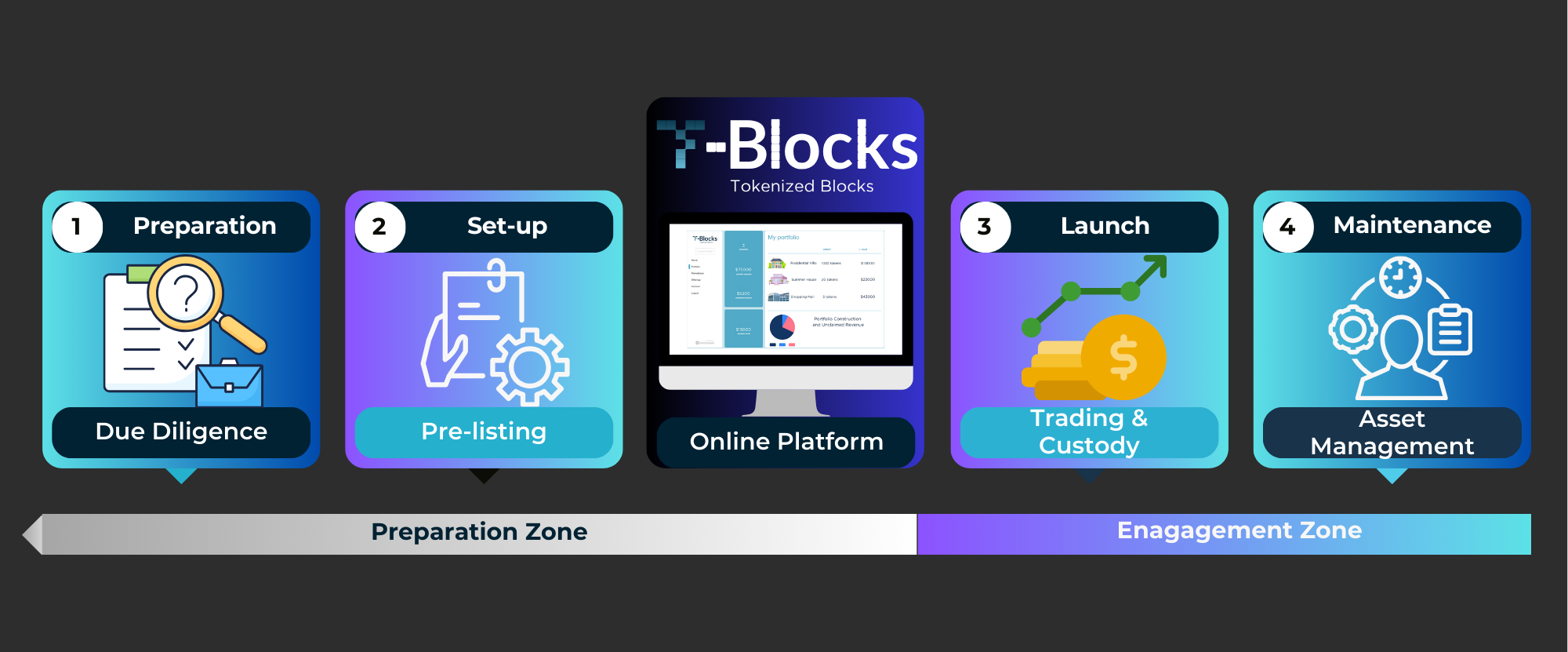

In Albania, this process is becoming a reality through platforms such as T-Blocks, which connects asset developers with global capital by using blockchain technology.

The planned infrastructure and real estate development in the country for the next 7-10 years is estimated to exceed 100 billion EUR, while the country’s 2022 Foreign Direct Investments (FDI) stood at 6.7% of GDP, totaling only 1.34 billion EUR.

How will tokenization and the influx of foreign capital-seeking growth affect this figure over the next five years? According to T-Blocks’ founder and COO, Henri Ndreca, their approach aims to increase the probability of conducting a successful tokenization and thus overcome the initial skepticism from the local and broader investment community.

“Locally and in the region, we serve Project Developers (builders and asset owners) to overcome liquidity challenges. So, in our experience so far with these (who can be very conservative towards adopting new technology), they have been to learn more and “get their hands” into tokenization to solve a millennia-long problem for them (how to finance projects faster and without liquidity risk),” Ndreca tells IT Logs.

The other side of the equation would be the “buy side.” Currently, these offerings are targeted to something other than local and regional investors, he adds.

“It is costly and risky to tokenize an asset and rely on retail and an untested market to sell it. That is why we are focused on serving Digital Asset funds, professional investors, family offices, and private investors from diaspora,” Ndreca says.

A new dawn for regional emerging economies

Recently, T-Blocks signed a partnership with Frankfurt-based StegX, a One-Stop-Shop ecosystem for institutional real estate investments. The platform facilitates investment and trading in traditional and tokenized real estate structures while fostering connections among stakeholders throughout the entire real estate investment lifecycle.

According to Ndreca, the partnership is now aimed to set new standards in the real estate industry.

“We aim to do this by leveraging StegX’s extensive global network to bring T-Blocks’ local expertise to a worldwide audience. This partnership will unlock a multitude of investment opportunities in the Balkans, a region ripe with potential yet under-explored by global investors,” he tells IT Logs.

Educating the regional ecosystem on tokenization

Regarding the process of bringing tokenization closer to the Balkans, T-Blocks has noticed several types of people.

“People who get tokenization, but do not get the Balkans (and its value drivers).

Then, there are people who get the Balkans, but do not get tokenization. People who do not get either (we do not engage with this group) and people who get both (we partner with them),” Ndreca explains.

According to him, the most extensive education and awareness will come after the tokenization of their first project in the pipeline, which is planned for this year.

“As more credibility is built and we successfully raise our seed round, we have in our plans a strategy (digital marketing, workshops, traditional media, etc.) to raise awareness and understanding of digital investments to local and regional customers as our long-term objective is to democratize investment access and grow financial inclusion of underrepresented retail market in the Balkans. We want to prepare our retail market for digital investments, but they will not be the primary segment for the first 2-3 years.” Ndreca concludes.