We are always excited to uncover and share the latest tech startups and talents in the SEE region. Today we’ll take a look at Veli, a startup and an app focused on making crypto investing effortless.

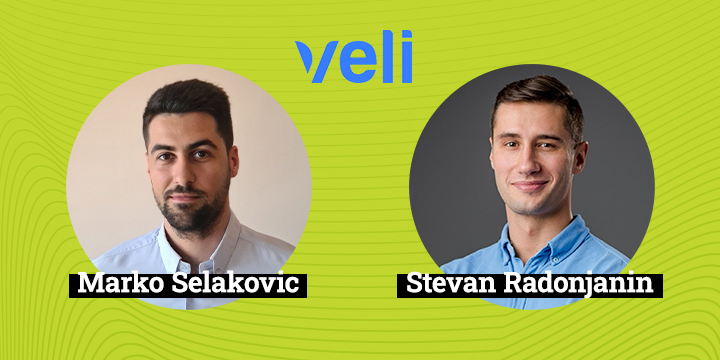

Veli was founded by Serbs Stevan Radonjanin the company’s CEO, and Marko Selaković, the acting CTO. Stevan, currently located in Austria, has a long-time career in the banking and fin-tech industry, from serving as a Corporate Relationship Manager to working 2+ years as business development manager for the first Austrian unicorn – BitPanda, now one of the leading European digital asset platforms. Marko on the other hand is stationed in Belgrade and has 10+ years of experience in software and mobile development.

The Veli startup was established in February, 2022, and we had a pleasure to meet these guys in Ohrid, North Macedonia during the MatchIn Investor Summit.

Tell us about Veli App? What does it do?

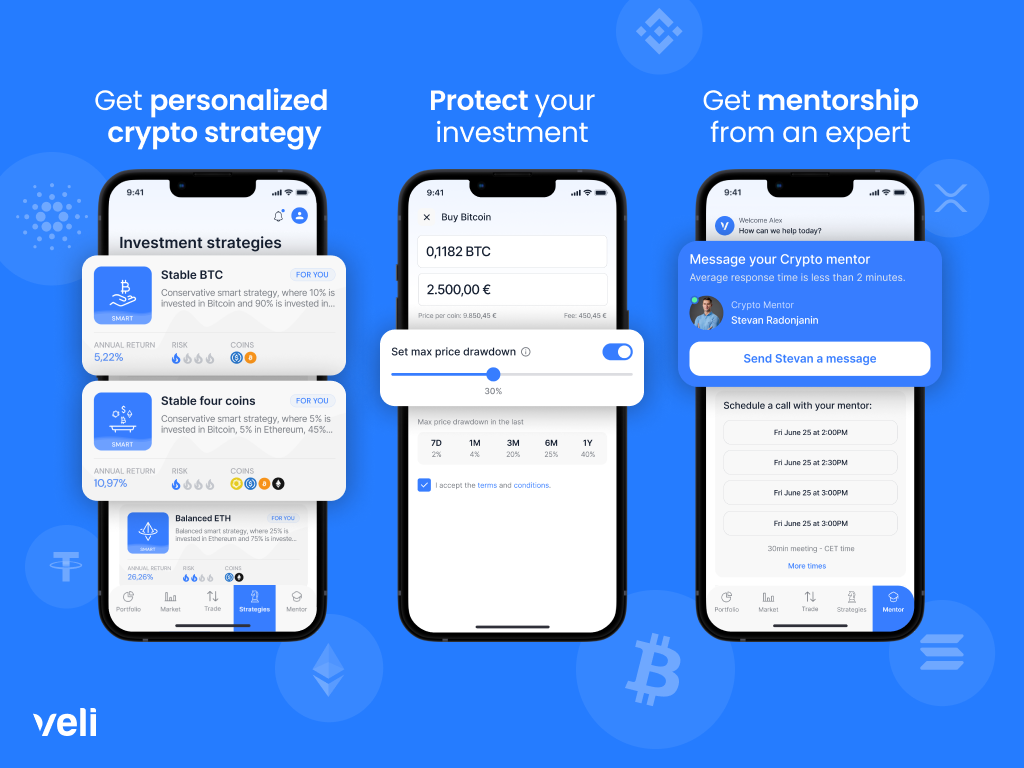

Veli is a platform which is democratizing crypto wealth management, helping retail investors invest like professionals. The new platform gives its users access to long-term wealth management strategies created by top experts, as well as 1:1 mentoring with crypto experts to close the knowledge gap. This hands-on tool will make smart investments accessible to everyone without the need for a financial advisor and hours spent daily on research and analysis.

Fun fact: Free for Women

Veli app is free for women to use. The founders claim that even though women know about crypto, they don’t feel invited and feel that crypto investing is a thing for men. So they are opening the doors to all women and making it possible for them to invest.How would you describe the Veli experience to someone unfamiliar with crypto?

Wealthy crypto investors have access to a personal wealth manager, which tells them what to buy, when to enter the market and when to take profit.

Investors which don’t have a minimum of 250k to invest, don’t have access to somebody like that. As a consequence, they are left on their own to research different cryptocurrencies, constantly look at charts to spot the right moment to buy and sell. Given that the majority don’t have the knowledge and time to do that, they are loosing money.

They enter the market when the prices are already near the top and sell with over 70% loss.

We at Veli are lowering the entry barrier for crypto wealth management (they don’t need 250k but can invest much smaller amounts).

How do we lower it? By giving investors a questionnaire to understand their investment goals and risk profile. Upon filling it, users will be presented with a set of investment strategies which suit their preferences the best, e.g. if they are a low risk investor, they will get conservative strategies. If they prefer higher returns, then they will get riskier strategies.

What inspired the creation of Veli? Who are the founders of the app?

The founders of the app are Stevan Radonjanin and Marko Selaković. Stevan studied quantitative finance at WU in Vienna, has 5 years of banking experience, last 5 years has been working in crypto and scaled 2 crypto brokers, one of which was Bitpanda, which became a Unicorn. He is doing this for the 3rd time. He gathered an experienced team to scale the business and become a Unicorn faster.

Marko is a serial entrepreneur, who worked for large companies like Sony but also for multiple startups, where as a CTO he built and scaled the tech teams from 0 to 30 people.

While working in the crypto industry, Stevan was asked by friends and family what cryptocurrency they should buy. After getting that question many times, he decided to put an ad on Linkedin and hire a person that would perform cryptocurrency research for him. He (Pavle) would research different cryptocurrencies, everything he can find on them, perform technical and fundamental analysis and would shorten it into an easily digestible 10 page summary. These summaries were so good, that Stevan started investing based on them and profiting. His friends liked the summaries too, which is when he realized there is an opportunity to solve a problem which many people have, which is “what cryptocurrency to buy, when to buy it and when to take profit”.

With that idea in mind, Stevan started working on a solution and gathered an amazing team. With personal money, the team managed to create an MVP. They raised capital from the founder of DeFi Saver, TradeCore and 40 Plus Capital and had the official launch in July.

How do you ensure that the strategies developed by the PhDs in quantitative finance are relevant and timely in such a volatile crypto market?

It’s a well known fact that most asset managers don’t outperform an index. We created index-like investment strategies for crypto. We have 2 types, passive and smart. Passive move up and down with the market. Smart ones buy crypto when prices are low a little bit over a course of months (taking certain on-chain indicators into account) and sell on the way to the top, a little bit over a course of months. The strategies are rebalanced every month, where some coins exit the strategy and new ones enter. That way the strategies remain relevant and up to date. We also have a quiz which helps users select the strategy that is relevant to them.

Can you elaborate on how the downside protection feature works?

It’s basically a very simplified version of trailing stop loss feature on more complex exchanges, but here instead of inputting many parameters, you just use a simple slider to determine max % drop from the top you are comfortable with. If you invest 1.000 EUR and put downside protection at 30%. Then, if the price immediately falls to 700 EUR, the asset you purchased will be sold. Conversely, if the price starts going up, and it goes to 10.000 EUR and then starts dropping, then your asset will be sold when the value drops to 7.000 EUR. That way, you have automatically locked in a profit of 6.000 EUR. So, the % is always measured from the highest top reached since you purchased. This feature is not yet live and will be implemented soon.

How do you choose the 100+ cryptocurrencies available on the Veli platform?

We are constrained by the availability of assets provided by our white-label provider Reyn Digital Assets, which uses multiple liquidity providers, to give us the best price. We perform research on every coin (see Veli Coin Guides) and select the largest and most reputable ones. Furthermore, we do not offer access to very small cap coins as they have high risk of going to 0, but tend to list only established coins which represent solid investments.

With cybersecurity being a major concern, how does Veli prioritize user security, especially concerning biometric-based identity verification and data encryption?

We leverage the license and the Compliance of our white label provider. Being a licensed virtual asset service provider, they need to adhere to high security standards imposed by the regulator. We use the most reputable identity verification providers, as well as regulated custodians, used by the largest crypto companies in the world.

Tell us about the licenses and regulations, which markets can you operate in?

As mentioned, we leverage the license of Reyn Digital Assets, which is our white label provider. They have several EU licenses, which allow us to serve better part of the European market, as well as some countries outside of Europe.

What sets Veli apart from other crypto investment platforms on the market?

With other platforms, you are fully on your own. You can either invest in individual assets or in passive strategies, which are in minus 75% during the bear market.

On the other hand, with Veli:

1) For the first time, there is an automated way for long-term investors to buy at the bottom of the bull-run and sell at the top, without the need to have any crypto knowledge.

2) We developed a simple yet actionable tool to help investors understand their risk level, set goals and achieve them by investing in proven and back-tested strategies developed by a team of PhD quants.

3) Mentors. We offer users a mentor they can speak to, to get started with crypto and bridge any knowledge gaps.

4) Simple slider to protect their investments from falling prices.

How do you see the world of crypto evolving in the next 5 years, and how does Veli plan to adapt?

We will see a huge inflow of institutional investors in crypto in the coming years. Moreover, we expect asset tokenization to become a huge topic and everything that has value will be tokenized. That is why we have established a partnership with DAP Capital, to be able to tokenize various assets and offer investors access to tokenized art, real estate and much more.

Are there any upcoming features or expansions that users can look forward to from Veli?

Yes, Downside protection and many others, but we will share more info about it when that time comes.