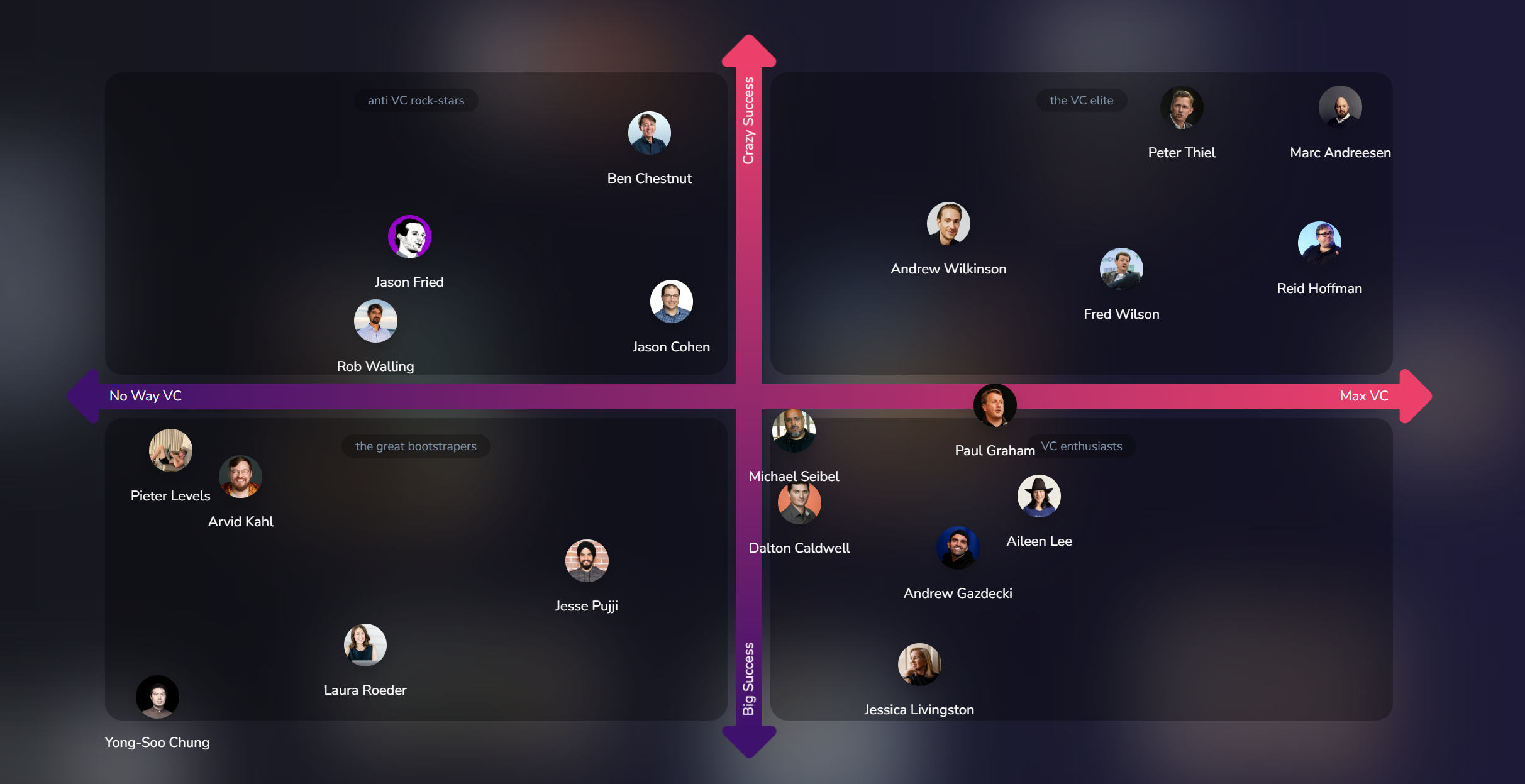

The startup world is a maze of decisions, with each path presenting its own set of challenges and opportunities. One of the most daunting questions entrepreneurs face is whether to raise venture capital or bootstrap their way to success.

It’s a question that sparks debates in boardrooms, coffee shops, online forums across the globe… pretty much everywhere! To shed light on this crucial decision, ToVCorNOT.com offers you insights from some of the most influential voices in the startup ecosystem.

Marc Andreessen: The easiest path

Marc Andreessen, the unicorn builder behind Mosaic and Netscape and co-founder of a16z, stands firmly in the camp of venture capital. He boldly claims, “Raising venture capital is the easiest thing a startup founder is ever going to do.” For Andreessen, VC funding is not just a financial injection but a strategic move that paves the way for exponential growth and market domination.

Reid Hoffman: More than you think you need

Reid Hoffman, the co-founder of LinkedIn and a prominent Silicon Valley investor, advocates for raising more money than initially anticipated. His rule of thumb? “Raise more money than you think you need!” Hoffman believes that ample capital provides startups with the runway to navigate uncertainties and capitalize on emerging opportunities.

Fred Wilson: The cheerleader’s role

Fred Wilson, a venture capitalist rockstar and partner at Union Square Ventures, emphasizes the importance of having a cheerleader in the startup journey. He points out that “a VC’s most important role is that of a cheerleader.” Wilson’s stance also underscores the value of having a supportive network of investors who not only provide capital but also offer guidance and encouragement during challenging times.

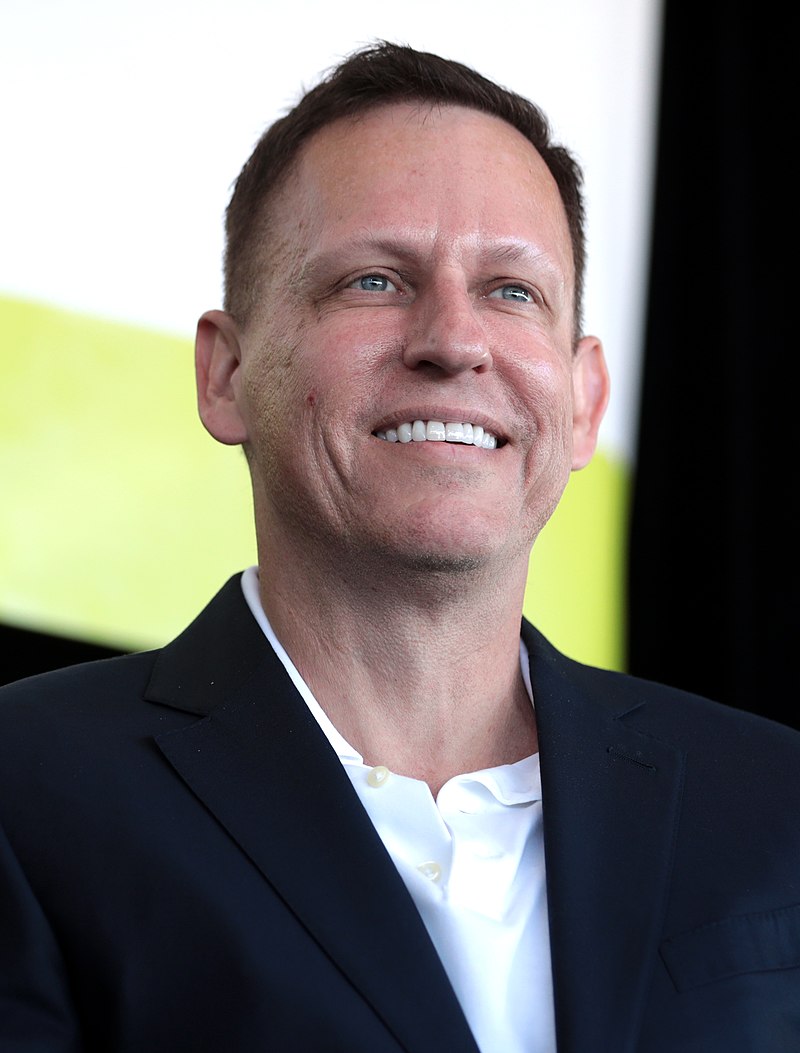

Peter Thiel: Dominating your industry

Peter Thiel, the co-founder of PayPal and Palantir, takes a strategic approach to VC funding. He believes that relinquishing a portion of equity is a worthwhile trade-off if it enables startups to assert dominance in their respective industries. Thiel famously states, “Giving up 25% of your business is worth it if it enables you to take over your industry.”

Michael Seibel: The YC perspective

Michael Seibel, managing director at Y Combinator and past co-founder of Justin.tv and Socialcam, brings a unique perspective from the renowned startup accelerator. Seibel’s experience underscores the value of mentorship, resources, and network access that come with VC-backed programs like YC, providing startups with a launchpad for success.

Paul Graham: Choosing growth

Paul Graham, the founder of Y Combinator, believes that taking VC funding allows startups to choose their growth trajectory. He argues, “Bootstrapping is a proper subset of taking VC. Taking VC lets a company choose its growth rate.” Graham’s viewpoint highlights the strategic advantage of leveraging external capital to accelerate growth and scale rapidly.

Andrew Wilkinson: The binary nature of VC

Andrew Wilkinson, co-founder of MetaLab and Tiny.com, warns against the binary nature of VC funding. He cautions, “The problem with raising venture is it’s binary. In the VC’s world, you’re either 0 or you’re a billion-dollar company.” Wilkinson’s perspective underscores the high-stakes nature of VC funding, where success is often measured in extremes.

Aileen Lee: The unicorn hunter

Aileen Lee, a prominent venture capitalist and co-founder of Cowboy Ventures, coined the term “unicorn” to describe startups valued at over $1 billion. Her perspective highlights the allure of achieving unicorn status through VC funding while also acknowledging the challenges and risks associated with scaling to such heights.

Andrew Gazdecki: Having realistic goals

Andrew Gazdecki, founder and CEO of Acquire.com, challenges the notion that billion-dollar valuations are the ultimate measure of success. He argues, “If you’re building a startup to create wealth, don’t raise VC. Selling a bootstrapped company for $1M-$10M is a more realistic goal and will change your life forever.” Gazdecki’s perspective emphasizes the importance of setting achievable milestones aligned with the startup’s objectives.

Pieter Levels: Independence through bootstrapping

Pieter Levels is a vocal advocate for bootstrapping and independence in the startup journey. His mantra, “You don’t need venture capital to build a startup,” resonates with aspiring entrepreneurs who prioritize autonomy and sustainability over rapid growth fueled by external funding.

Jason Fried: Fund yourself

Jason Fried, co-founder and CEO of 37signals, champions the bootstrapping ethos with his view that “fund yourself.” Fried’s approach emphasizes self-reliance and building a sustainable business model without relying on external investors. For him, outside money is plan B, with the focus squarely on organic growth and customer satisfaction.

Arvid Kahl and Rob Walling: Bootstrapping champions

Arvid Kahl, author of “Zero to Sold,” and Rob Walling, founder of MicroConf and Startups for the Rest of Us, are staunch proponents of bootstrapping. They advocate for a middle ground between VC funding and self-funding, emphasizing the viability of indie funding models for startups seeking sustainable growth and profitability.

Ben Chestnut and Jason Cohen: Success beyond VC

Ben Chestnut, the bootstrapped success story behind MailChimp, and Jason Cohen, builder of bootstrapped unicorns SmartBear and WPEngine, prove that success can be achieved without ever raising a dollar of outside funding.

As Chestnut says, “I’m just really proud to say: I did it my way!”. For Cohen, while raising money is a market of “having more fuel for the fire”, it is “neither required for ‘success’ nor a marker of ‘success’”.